“Η εξαιρετική επίδοση στην ‘Ασκηση Προσομοιώσεως Ακραίων Καταστάσεων επιβεβαιώνει την ισχυρή κεφαλαιακή βάση της Alpha Bank, και την ικανότητά μας να επιτυγχάνουμε τους στρατηγικούς στόχους μας”, τόνισε ο διευθύνων σύμβουλος της Alpha Bank, Δημήτριος Π. Μαντζούνης, μετά την ανακοίνωση των αποτελεσμάτων.

Όπως επεσήμανε, η κεφαλαιακή θέση της Alpha Bank, η υψηλότερη μεταξύ των ελληνικών τραπεζών, της επιτρέπει να εφαρμόσει το σχέδιό της για τη μείωση των Μη Εξυπηρετούμενων Ανοιγμάτων και να συμβάλλει στην ανάκαμψη της οικονομίας, ενισχύοντας περαιτέρω την ανάπτυξη των ελληνικών επιχειρήσεων.

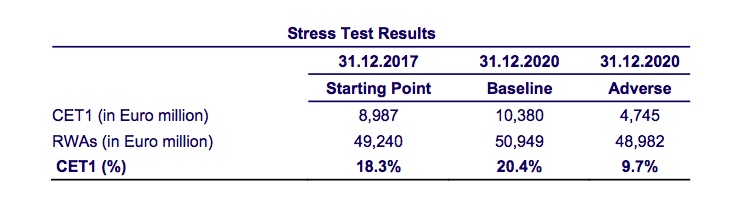

Alpha Bank announces 2018 Stress Test result 2020 CET1 ratio of 9.7% in adverse scenario and 20.4% in the baseline scenario

- Alpha Bank successfully concluded the 2018 Stress Test conducted on the four systemic Greek Banks.

- The Stress Test was conducted based on a static balance sheet approach under a baseline and an adverse macro scenario with a 3 year forecasting horizon (2018-2020). The starting point was December 31st, 2017, re-stated to account for IFRS 9 impact.

- Impact was assessed in terms of CET1 ratio. No hurdle rate or capital thresholds were applied for this exercise.

- Under the baseline scenario, 2020 CET1 ratio reached 20.4%, following an aggregate impact of +212bps post IFRS 9, mainly driven by a strong pre provision ιncome generation.

- Under the adverse scenario, 2020 CET1 ratio stood at 9.7%, down by 856bps, post IFRS 9, largely driven by the negative impact of Credit Risk resulting from the stressed macro environment and methodological constraints.

- Based on feedback received by the Single Supervisory Mechanism, the Stress Test outcome, along with other factors, have been assessed by its Supervisory Board, pointing to no capital shortfall. Therefore, no capital plan was required, as a result of the exercise.